Speakers attend a session at the Vietnam Investment Forum 2026 in HCM City on November 4. Photo courtesy of the organisers

After several turbulent years marked by global trade disruptions and shifting tariff regimes, Vietnam is re-emerging as one of Asia’s most promising growth stories, with economists and investors forecasting a decisive upswing in 2026 driven by export recovery, resilient domestic demand, and renewed foreign investment.

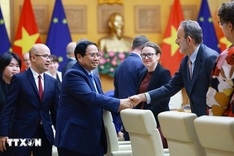

At the Vietnam Investment Forum 2026 in Ho Chi Minh City on November 4, policymakers, economists, and business leaders expressed cautious optimism about the country’s economic outlook, highlighting its expanding role in global supply chains, improving fundamentals, and stable policy environment.

Le Duy Binh, director of Economica Vietnam, said the country remained among the few economies capable of sustaining robust growth despite global headwinds.

“Vietnam is one of the few economies capable of maintaining growth between 6.5 and 7 per cent in a volatile global context, and we can do even better in 2026,” he said.

Exports, foreign investment, and domestic consumption were all regaining strong momentum, he added.

Economists said Vietnam continued to benefit from global supply-chain diversification away from China.

New foreign direct investment inflows, particularly in electronics, semiconductors, renewable energy, and logistics, increased steadily through 2025.

Vietnam’s total export-import turnover is expected to reach between USD 800 billion and USD 850 billion in 2026, reflecting deeper trade integration and expanding production capacity.

Le Anh Tuan, chief economist at Dragon Capital, said the shift toward high-tech manufacturing and green industries was accelerating.

“FDI flows into high-tech manufacturing and green industries are gathering pace. If policy execution remains consistent, Vietnam could achieve GDP growth of 8 to 10 per cent in 2026,” he said.

‘Remarkably positive progress’

Sacha Dray, economist at the World Bank Vietnam, speaks at the Vietnam Investment Forum 2026 in HCM City on November 4. Photo courtesy of the organisers

Sacha Dray, economist at the World Bank Vietnam, said the country had shown “remarkably positive progress” despite global challenges, citing recovery across multiple sectors.

“Vietnam’s business registrations have increased by 8.2 per cent year-on-year, the fastest rate in the region, while exports to the US have risen by 23 per cent to a record USD 113 billion,” he said.

“These figures reflect both the resilience of Vietnamese enterprises and the effectiveness of macroeconomic policies.”

Dray, who focuses on fiscal policy and economic development at the World Bank’s Hanoi office, added that growing foreign reserves and prudent monetary policy provide a strong buffer against external shocks.

“If these positive trends continue, Vietnam could position itself as one of the most dynamic investment destinations in Asia in 2026,” he said.

Core growth engines

Forum participants identified public investment, private and foreign capital, and domestic consumption as Vietnam’s three core growth engines in 2026.

Accelerated infrastructure disbursement, continued private-sector expansion, and strong retail demand, which rose 9 to 11 per cent this year, were highlighted as major drivers.

Phan Duc Hieu, permanent member of the National Assembly Economic Committee, said stable macroeconomic indicators were sustaining investor confidence.

“Vietnam’s moderate inflation, low public debt, and controlled exchange rate form a solid foundation for long-term growth,” he said.

Economist Dinh The Hien stressed the importance of execution.

“Our infrastructure strategy is ambitious, but we must move from ‘next year we will’ to ‘this year we do’,” he said.

Nguyen Ngoc Linh, CEO of DNSE Securities, said continued efforts to upgrade market infrastructure and lift foreign-ownership limits would be vital to raising Vietnam’s stock market to emerging-market status, a milestone that could unlock billions in new portfolio inflows.

“With foreign ownership still at 14.5 per cent of total market capitalisation, there is significant room for expansion as reforms deepen,” she said.

Despite global uncertainty and geopolitical tensions, investor sentiment toward Vietnam remains upbeat.

Experts agreed that policy stability, consistent implementation, and reform continuity will determine whether Vietnam can sustain momentum.

“Vietnam has proven its resilience,” said Binh of Economica Vietnam. “The key to maintaining competitiveness is policy stability. Investors value predictability as much as growth potential.”

Nguyen Anh Duong, economist at the Central Institute for Economic Management, said the next stage would require both speed and discipline.

“This is the time for Vietnam to move from resilience to acceleration,” he said. “If confidence and execution stay strong, 2026 could mark a breakthrough year for the economy.”

The annual event was organised by VietnamBiz and Vietnam Moi online news outlets.